Exploring the Role of BTC Staking

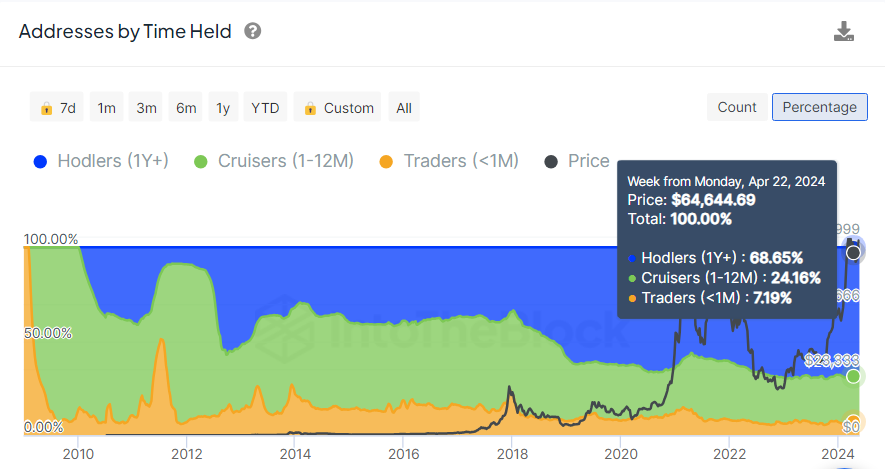

To explore the role of BTC staking, we must first know who holds it. BTC has low volatility compared to Altcoins and Meme Coins. As of 22 April 2024, 68.65% of BTC investors have held it for over a year, revealing that most are long-term risk-averse investors.

Also, BTC's current cross-chain wrapped version carries security risks and low returns. As a result, whales usually just HODL BTC and resist fractions of moving it out of cold wallets.

But something special did happen in this cycle: Assert issuance solutions like Ordinals and Runes unlock BTC's potential. We believe that BTC staking is essentially a demand for greater capital efficiency. The most important value proposition is maximizing BTC returns while keeping funds safe.

After the SEC approved the BTC ETF, BTC has garnered increasing attention from traditional institutions and investors. If BTC staking offers attractive yields while ensuring that funds are secure and protected, it will open up new narratives: BTC LSD (Liquid Staking Derivatives) and LRT (Liquid Restaking Tokens). As the most recognized crypto asset, lower volatility and higher yields provide institutions with better investment options.

Building an ecosystem around BTC is also helpful in maintaining network security. Each time Bitcoin halving increases the cost of mining and makes it less profitable. When mining profits keep dropping, unprofitable miners shut down their machines. Naturally, when the number of machines decreases, it is easier to attack Bitcoin because it is easier to control over 50% of hash power. However, we have seen the Ordinals and Runes give subsidies to miners. So, building a BTC ecosystem that pays fees to miners as a subsidy could make the network more secure.

BTC Staking Landscape

Validators economically secure PoS blockchains. PoS token holders can stake their tokens to secure the network in exchange for rewards. Differing from it, Bitcoin is PoW-based, and miners secure the network by contributing hashes. Therefore, BTC naturally cannot be staked, as network security does not require tokens but hashing power. There are four ways to stake BTC now:

- Custodial Lending

Custodial platforms allow Bitcoin holders to earn interest when lending their BTC to those who want to open short positions.

- Wrap + DeFi Lending

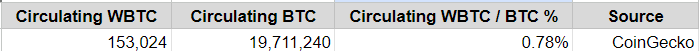

Bitcoin is heterogeneous with other blockchains and thus cannot communicate directly with each other. BTC must be bridged to a wrapped version on the target chain. In 2019, BitGo launched Wrapped Bitcoin (WBTC), BTC's most popular wrapped version. This centralized custody solution allows users to put their BTC under BitGo's custody and mint wBTC 1:1. To redeem BTC, users can burn their wBTC to receive an equal amount of Bitcoin. Whereas circulating WBTC only takes ~0.78% of the circulating BTC. Idle BTCs are still waiting for their liquidity to be used.

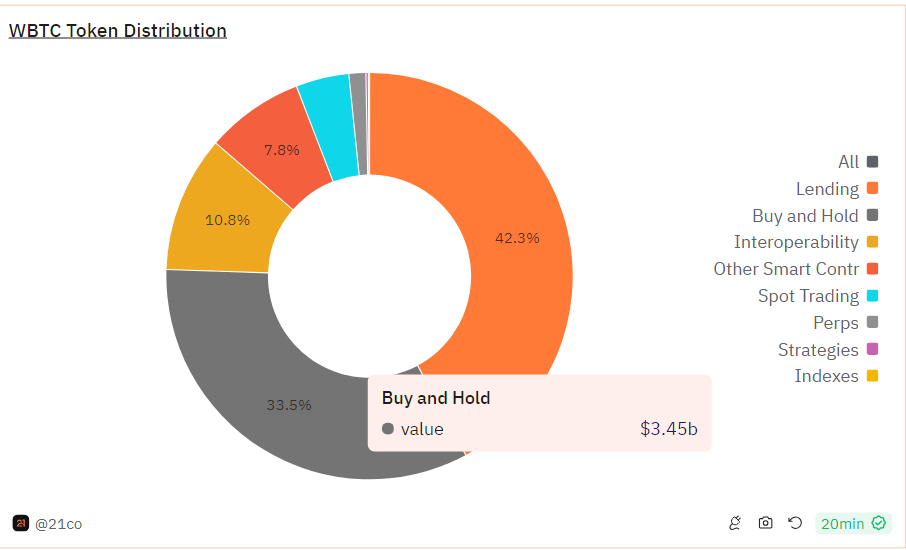

According to 21.co's Dune Dashboard, most of the circulating WBTC is used for lending in DeFi (42.3%) or just HODL (33.5%). WBTC supply APY ranges from 0.01% to 1.31% on lending protocols as per DeFiLlama. When considering the transaction fees incurred when wrapping BTC, just HODL BTC in the cold wallet waiting for price surging is more attractive than lending or holding WBTC in EVM blockchains.

- BTC Layer 2: Wrap + L2 Token Reward

Mainstream BTC Layer 2 solutions include state channels, sidechains, and rollups. Most BTC L2 "staking" works by bridging BTC to its native wrapped version and locking it for native token airdrops.

- Restake

As EigenLayer did in Ethereum, Babylon used staked BTC to secure PoS blockchains. Rewards come from service fees PoS chains paid when purchasing Babylon's BTC-based shared security.

Core network: BTCFi

The Core network is an EVM-compatible Bitcoin Sidechain that aims to build the BTCFi ecosystem. Its major components are Satoshi Plus Consensus, Native BTC Staking, and coreBTC.

TL;DR

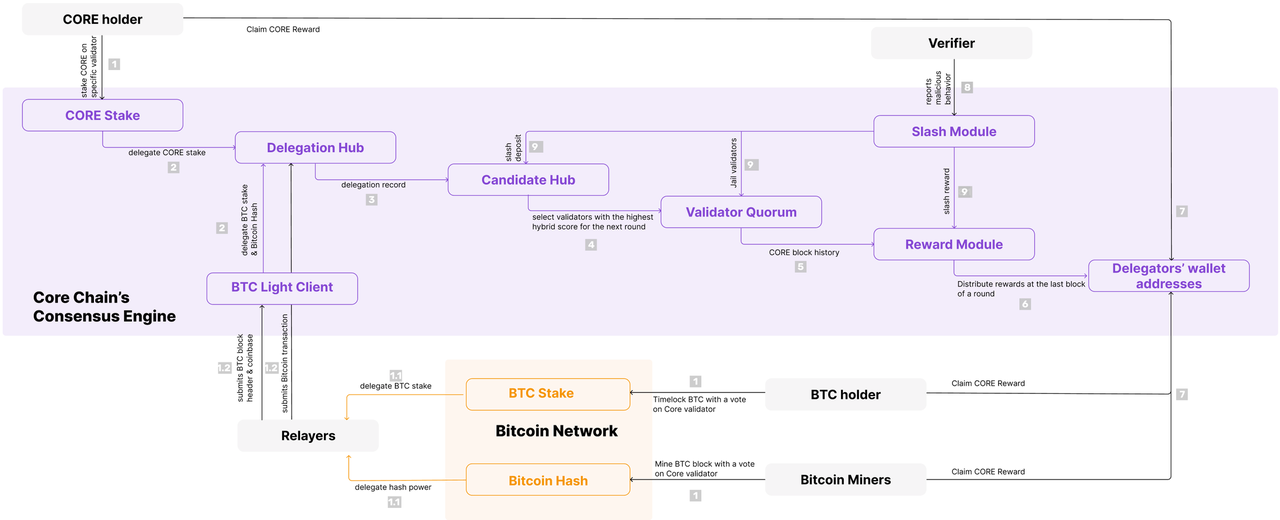

- Satoshi Plus Consensus aligned the interests of both Bitcoin and Core. BTC miners, BTC stakers, and $CORE delegators can earn rewards by delegating their hash power / BTC / $CORE to Core validators.

- Non-custodial BTC staking allows BTC holders to stake BTC in the Bitcoin network and earn $CORE.

- CoreBTC is an over-collateralized wrapped version of BTC on the Core network. Lockers who custody users' BTC must first over-collateralize $CORE.

Satoshi Plus Consensus: Bitcoin miners and holders into the game

Satoshi Plus is the consensus algorithm of Core that combines Delegated Proof of Work (DPoW) and Delegated Proof of Stake (DPoS). Combining these two consensus algorithms allows Bitcoin miners and holders to participate in the Core network's consensus and receive rewards. One of the most significant advantages of Satoshi Plus is that it builds a symbiotic relationship with the Bitcoin network, which ensures no conflicting interests between the Bitcoin network and the Core network.

Stakeholders

Validators

Validators produce blocks, validate transactions, and process unavailable slash on the Core network. They receive hash power, non-custodial BTC delegate from Bitcoin, and $CORE from the Core network. To operate a validator, you must run the Core full node in validator mode and register on the Core stake website.

BTC Miners

Bitcoin miners solve cryptographic hash puzzles to mine new blocks. They can add some information in the op_return field, a script opcode that marks a transaction output as invalid. When miners successfully solve cryptographic hash puzzles, they produce blocks in a special form called "coinbase transaction." They can delegate their hash power to Core network validators by adding information in the op_return field of the coinbase transaction and earn $CORE. Since delegation in DPoW reuses the Bitcoin network's hash, it will not make miners choose which to secure between Core and Bitcoin. Yet other protocols may require miners to add their information, thus exceeding 80 bytes (the size of op_return).

BTC Stakers

Bitcoin holders can non-custodial stake BTC in the Bitcoin network to earn yields.

Core Delegators

Core holders can delegate their $CORE to validators and earn rewards for consensus participation.

Relayers

Since Bitcoin and the Core network cannot communicate, Core cannot directly involve Bitcoin miners. So here come the relayers. They run relay services to fetch Bitcoin block headers and transmit them to the Core network via light client contract for hash power delegation.

There are 22 relayers live on the Core network now. Anyone can become a relayer by paying a refundable registration fee of 100 $CORE and depositing more than 10 $CORE for transaction fees. When a relayer wants to exit, a 1 $CORE deregistration fee will be charged, and the remaining 99 $CORE will be returned.

Verifiers

Verifiers identify and report malicious double-signing activities of validators. If they successfully flag such behavior, validators will be slashed or jailed. Verifiers receive rewards for their monitoring efforts when block rewards are distributed. Also, verifiers are permissionless and do not need to turn specific services like relayers.

DPoW

DPoW is performed by bitcoin miners and mining pools that delegate existing bitcoin hash power to validators on the Core network. To participate in the consensus of Core network, Bitcoin miners only need to add two additional pieces of information in the op_return field of the coinbase transaction:

- The address of the core validator used to receive the hash rate.

- EVM-compatible address for receiving $CORE rewards.

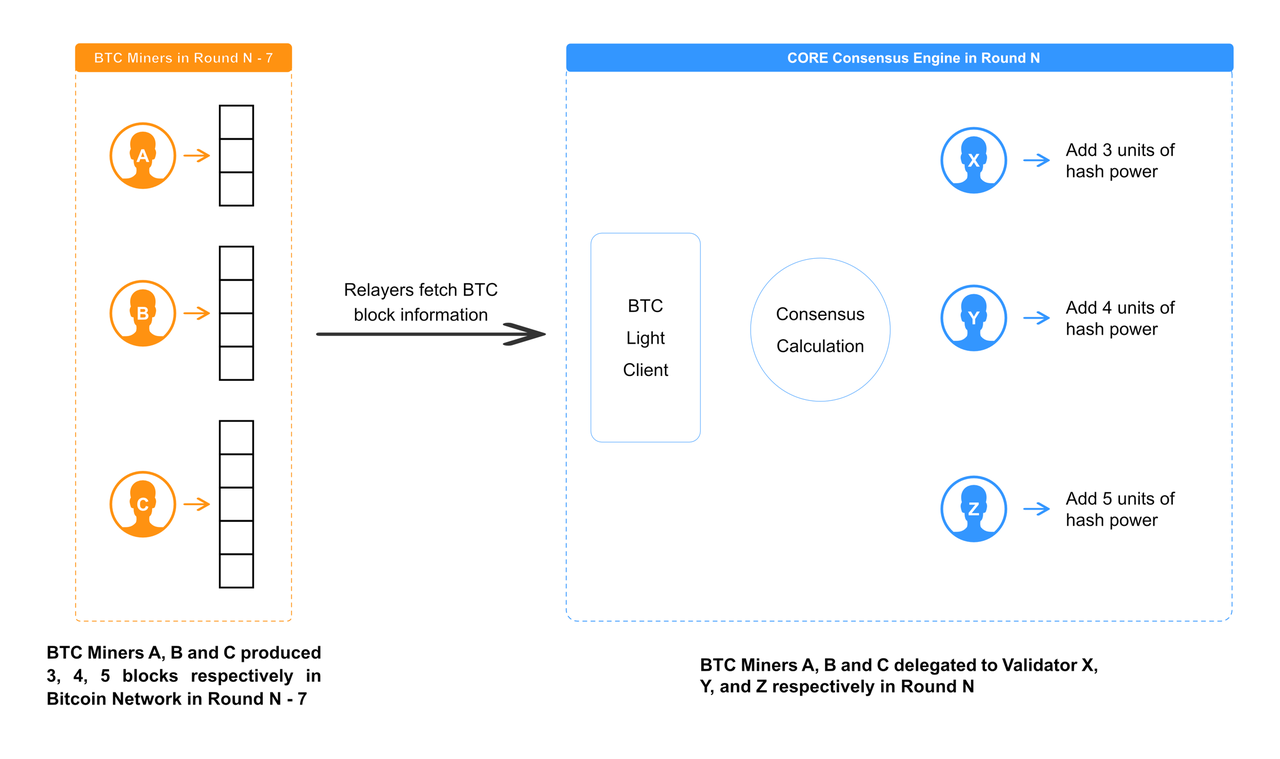

When a miner adds validator A info into op_return, validator A gains 1 hash power, and Miners / Mining Pools earn additional revenue by delegating their hash power to vote for Core validators. They are rewarded with $CORE and coinbase rewards for mining blocks on the Bitcoin network. Therefore, Satoshi Plus created a win-win case: BTC miners and pools earn additional yield, and the Core network gets the attention of Bitcoin OG and whales. Bitcoin block headers enter the Core network through relayers. Relayers synchronize blocks mined by the Bitcoin miner with the CORE network. In 1-day rounds, the core network calculates the DPoW for each validator by counting the number of blocks miners delegated to each validator a week ago.

If round N occurs on Thursday, the Core network will tabulate the hash power delegated to each validator by counting the blocks from last Thursday (round N-7). From the above figure, we can see that BTC miners A, B, and C produced 3,4,5 blocks, respectively, in rounds N-7. When relayers flow info to the Core network, BTC miners A, B, and C delegate the hash power they produced on Bitcoin to validators X, Y, and Z at Core.

DPoS

As mentioned, Satoshi Plus's most critical point is aligning Bitcoin and Core's interests. DPoW gets BTC miners involved, while DPoS secures Core's interests. PoS blockchains like Ethereum have a minimum staked coin threshold. Due to the low entry threshold, DPoS is more friendly for retail investors than PoS. In Core, holders can delegate their $CORE to validators (minimum delegation of 1 $CORE or 0.01 $BTC).

Scores and Weighting Factors

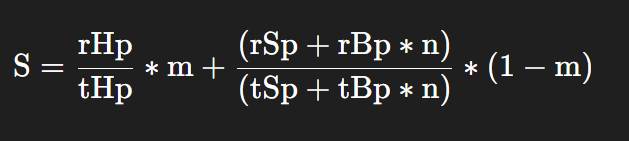

Validators are elected based on the hybrid score S of delegated hash power, non-custodial BTC stake, and $CORE stake.

Where:

- rHp: Bitcoin hash power delegated to the validator

- tHp: total hash power

- rSp: the amount of $CORE delegated to the validator

- tSp: the total amount of $CORE staked

- rBp: the amount of BTC delegated to that validator

- tBp: the total amount of BTC staked

- m: a dynamic factor that controls the weights of Bitcoin hash power vs. BTC and $CORE stakes (0<m<1)

- n: a dynamic factor that controls the voting power of each BTC vs. each $CORE

We want to point out that two dynamic factors, m and n, are the keys to the consensus. m controls the weights of DPoW vs. DPoS, and n controls the weights of each BTC vs. each $CORE in DPoS. These two factors balance stakeholders and reveal where Core aims to go.

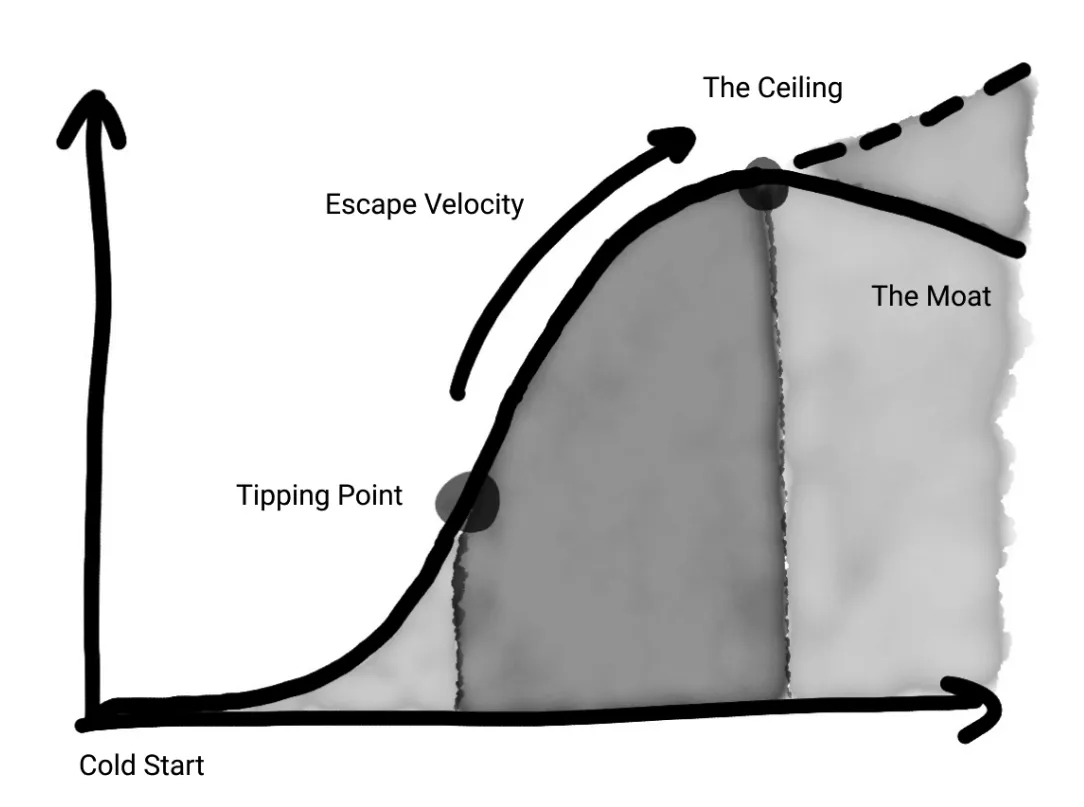

Factor m has changed from 2/3 to 1/5 from the beginning to now. Such change means hash power /stakes weight changed from 2/3 to 1/5. According to the data, Core aims to attract BTC miners first, which is reasonable since BTC miners can bring attention and share security. A DPoS-based blockchain is very fragile at cold-start since economic security (i.e., staked Coins) is insufficient and coin prices are volatile. By getting miners involved, Core is secured by the security of the Bitcoin network. Meanwhile, miners can bring BTC community support Core to increase staked coins and economic security (i.e., more staked coins). As of June 7th, ~52% hash rate of the Bitcoin network already secured Core.

Some benefits will inevitably go to the Bitcoin network to leverage its security. However, relying solely on an external network is not a long-term strategy. The only moat for L1 chains to succeed is the token-centric ecosystem.

The Tipping Point in the Cold Start Theory refers to the moment when a networked product or service has gained enough traction in a smaller, initial network (the 'atomic network') that it can begin to expand and conquer more extensive networks. Based on the vision of building BTCFi in Core, giving more weight to stakes (from 1/3 to 4/5) offers more significant yields, effectively bringing more funds to the Core ecosystem. Participants who commit time and opportunity costs to staking will receive proportionately higher returns.

This incentivizes early stakers and $CORE investors, creating an initial 'atomic network.' Concentrated yields can act as a powerful magnet, drawing in participants who see the potential for high rewards. This influx of capital and engagement can drive the network towards its tipping point faster.

Meanwhile, n shifted from 50,000 to 25,000 (Since Bitcoin has eight decimal places while Core is 18, n would be multiplied by 1e10 for scaling in the calculation). This means the weight of each BTC vs. each $CORE is halving. It also means that the current highlight is building an ecosystem around its token, $CORE.

Consensus Process

Hybrid-scored based Validator Election

The core network updates the validator set and distributes rewards round after round. Currently, a round lasts one day. At the end of the last round, validators are quicksorted in order of their hybrid score, and the 21 validators with the highest hybrid scores are selected for the validator set in this round.

Block Production

Each 1-day round is divided into multiple 3-second slots. All elected validators in the set are responsible for producing one block per slot in a round-robin manner.

Validator Regulation: Slashing and Jailing

Slashing and jailing are incentive mechanisms that make acting right more profitable than acting maliciously. Slashing means deducting rewards or stakes, and Jailng means a specific validator cannot be elected to produce blocks. In Core, normal validators are responsible for report unavailability (missed blocks), while verifiers are responsible for report double signing. We list the following cases in the order of severity:

- Misdemeanor Unavailability: If a validator continuously misses 50 blocks, its accumulated $CORE rewards will be fully slashed

- Felony Unavailability: If a validator consistently misses 150 blocks, they will be ineligible to receive daily $CORE rewards, and 10% of their $CORE stakes will be slashed. Additionally, they will be jailed for three days.

- Double Signing: Double signing indicates that a validator signed two blocks at an equal height. Unavailability is reasonable due to network fluctuation, but double signing is strong evidence of acting maliciously. So if a validator is caught double signing, its $CORE stakes will be fully slashed and jailed forever.

Generally, redundancy design is done alongside validator operations. If a validator node fails, a backup server replaces it to ensure high availability. However, if the main validator suddenly recovers, it may cause non-malicious double signing.

To exclude malicious validators from consensus, existing Core validators examine any validator jailed per epoch (200 slots = 10 min). Any caught jailed validators will be kicked out in the next epoch.

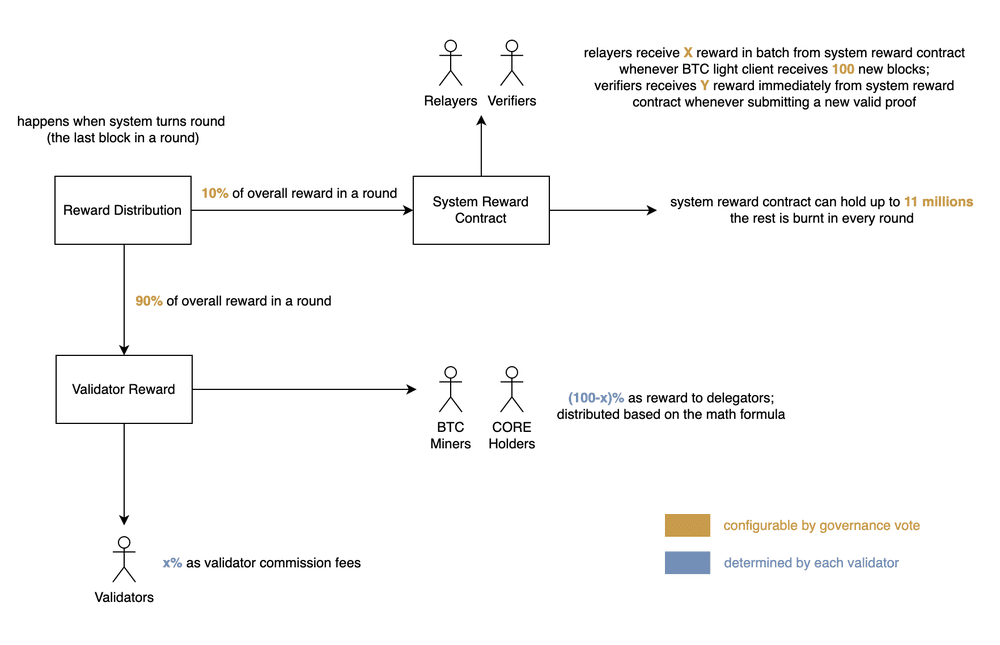

Rewards

Validators can receive both base rewards (alias of coinbase rewards) and transaction fees when successfully producing a block.

Validators take x% commission from 90% base rewards and distribute remained to BTC miners, non-custodial BTC stakers, and CORE stakers.

Choosing a validator with fewer delegates gives more $CORE to delegators (validator stakes ↓ delegator rewards ↑). Since validators are selected to produce blocks in a round-robin manner, their basic reward expectations are similar. Thus, choosing a newbie validator can get more $CORE and improved network decentralization.

10% of the base rewards are sent to the system reward contract, where relayers and verifiers can manually claim rewards. Relayer rewards are calculated every 100 Bitcoin blocks. Verifiers instantly receive 500 $CORE in the same transaction if the double signing report is valid. Currently, the cap of the system reward contract is 10M. Any rewards exceeding the cap will be burned.

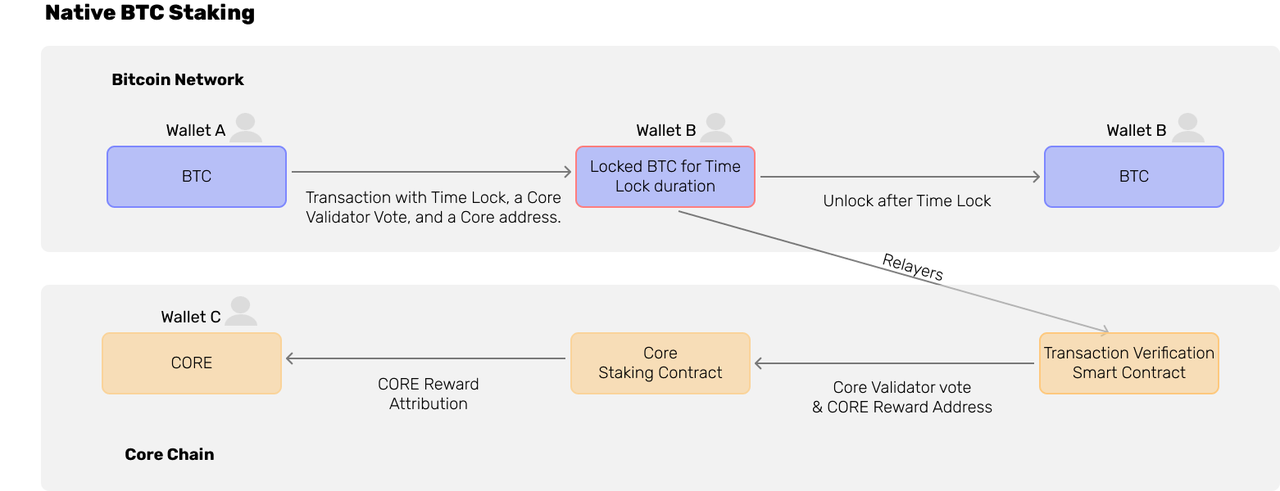

Native BTC Staking

Core's Native BTC Staking doesn't fall into any of the categories we've mentioned, but fits the key value proposition of BTC Staking:

- Maximize BTC Returns ⇔ $CORE Rewards;

- Security ⇔ Stake BTC on the Bitcoin Network.

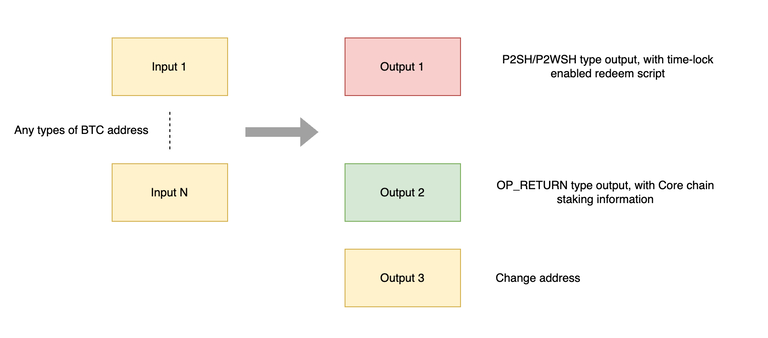

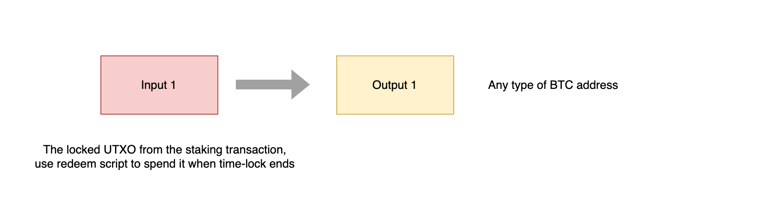

The Core network enables native BTC staking using OP_CHECKLOCKTIMEVERIFY (CLTV) timelock. CLTV Time Lock is an opcode that locks a fixed amount of time or block height before spending bitcoins from a transaction output. To stake BTC natively, users lock their BTC within the Bitcoin network for a fixed period. Relayers then transmit Bitcoin headers to the Core network, notifying it that the BTC has been locked. The core network leverages staked BTC weight to calculate hybrid scores and earn $CORE rewards. Once the lock duration expires, users can utilize redeem scripts to retrieve their BTC.

The workflow of a user who delegates BTC to the core blockchain is shown below:

- A user creates a Bitcoin transaction and locks up a certain amount of BTC in one of the transaction outputs for a certain time or block. The transaction should also have an op_return output containing the staking information, such as the validator and reward addresses.

- Transmit the transaction to the Core blockchain using the delegateBtc method.

- The user can claim rewards using the reward address set in Step 1 during the staking period.

- The user can spend the time locked UTXO using the redeem script when the lock expires.

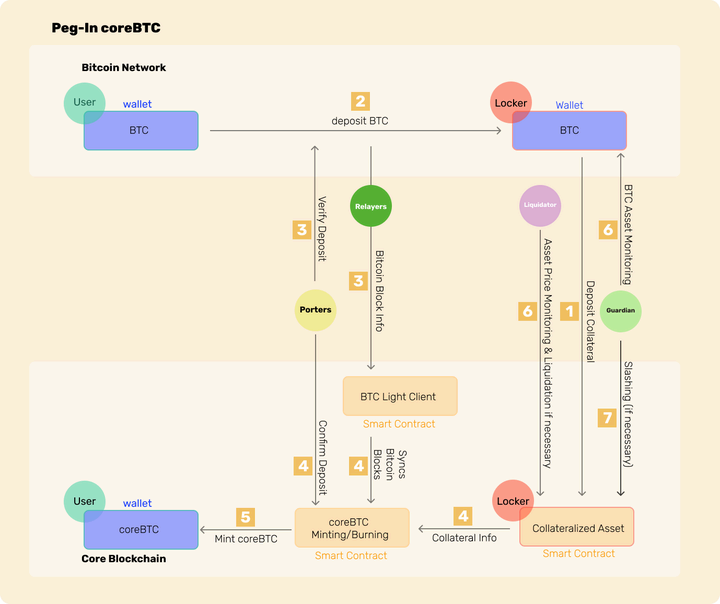

coreBTC: Over-Collateralized External Verification Bridge

The Core network uses an external verification bridge that wraps BTC to coreBTC. It relies on permissionless lockers to over-collateralize $CORE and takes the risk of liquidating to prevent coreBTC de-peg. As Messari said in their report, coreBTC is a permissionless multisig bridge secured by over-collateralization and liquidation.

Stakeholders

- Lockers

Lockers are custodians responsible for holding users' BTC on the Bitcoin network. Anyone can register as a locker by over-collateralized $CORE.

- Relayers and Porters

In the Satoshi Plus section, we mentioned relayers fetching Bitcoin headers and transmitting them to the Core Light Client smart contract. At the same time, they help coreBTC to verify transactions on BitcoinRelayLogic contract. Now that we have Bitcoin information on Core, we need to know which user wants to mint coreBTC.

Porters are made to bridge that gap: they monitor incoming transfers to lockers on Bitcoin and send transaction receipts to Core to mint coreBTC.

- Liquidators

Liquidators monitor collateral value and initiate liquidation if the value is below the threshold.

- Guardians

Guardians are responsible for slashing lockers' malicious behavior. A locker will be slashed when move locked BTC when there are no redemption requests or failed to fulfill redemption requests within the deadline.

Mint coreBTC

- To become a locker, one must lock at least 100,000 $CORE with a 150% collateralization ratio ($CORE collateral value / $coreBTC debt value) and wait for approval.

- Users deposit BTC to Lockers' Bitcoin wallet.

Porters monitor deposit transactions and send proof to Core when confirmed on Bitcoin. - coreBTC contract verifies transactions by headers relayers submitted.

- coreBTC contract mint coreBTC 1:1 to Users' Core wallets.

- Locker receives a 0.15% incentive fee (based on the amount of CoreBTC minted) for every mint transaction.

Current Lockers Data on 2024.6.13:

Health Factor: 190.31%

Collateral: 3,000,100 $CORE

Health Factor: 153.24%

Collateral: 2,100,000 $CORE

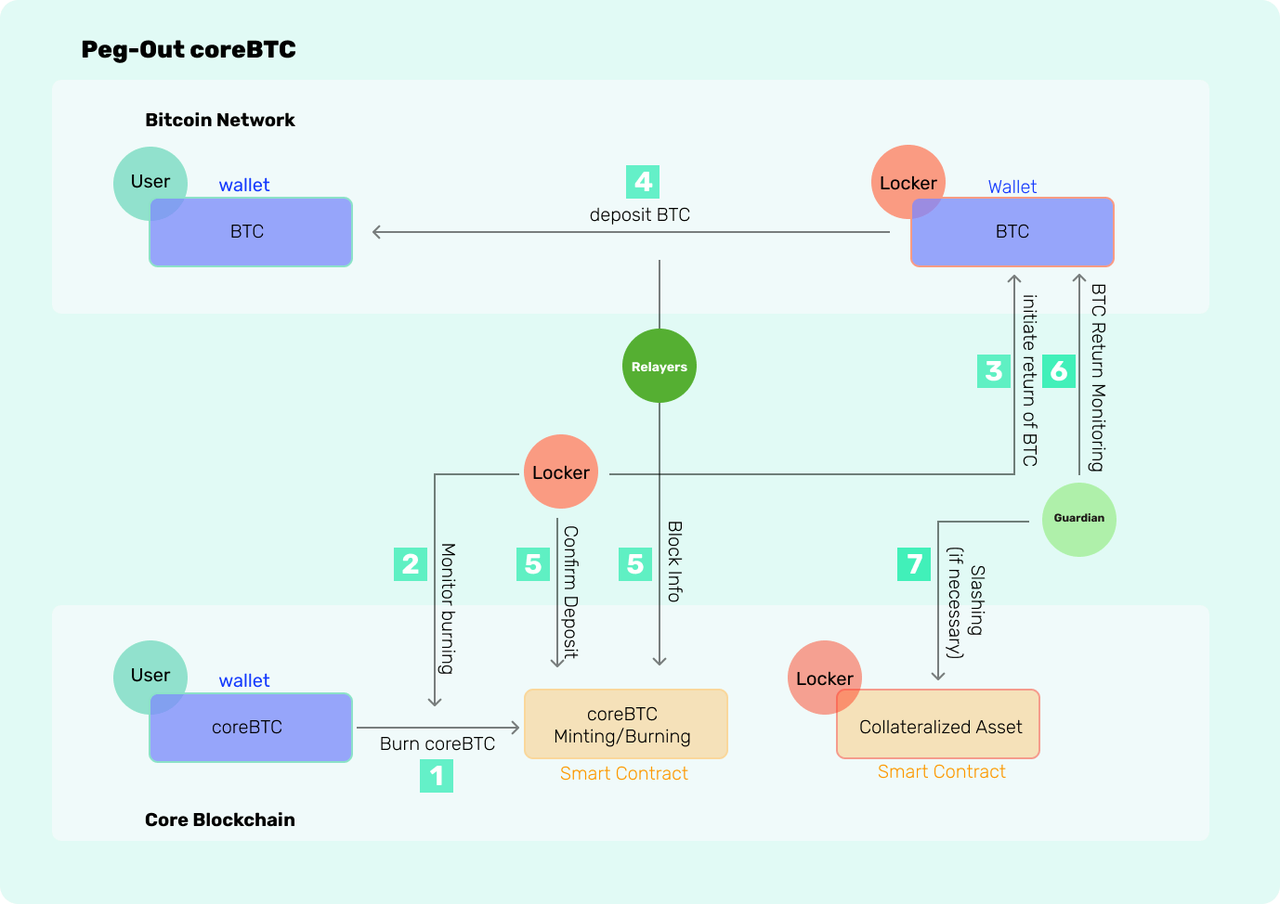

Redeem coreBTC

- Users send redemption requests to the coreBTC contract.

- coreBTC contract burns coreBTC.

- coreBTC contract alerts lockers to retrieve BTC 1:1 to Users' Bitcoin wallets.

- Lockers unlock BTC and send it to users' Bitcoin wallets.

- Guardians monitor if lockers return BTC and send proof to Core when confirmed on Bitcoin.

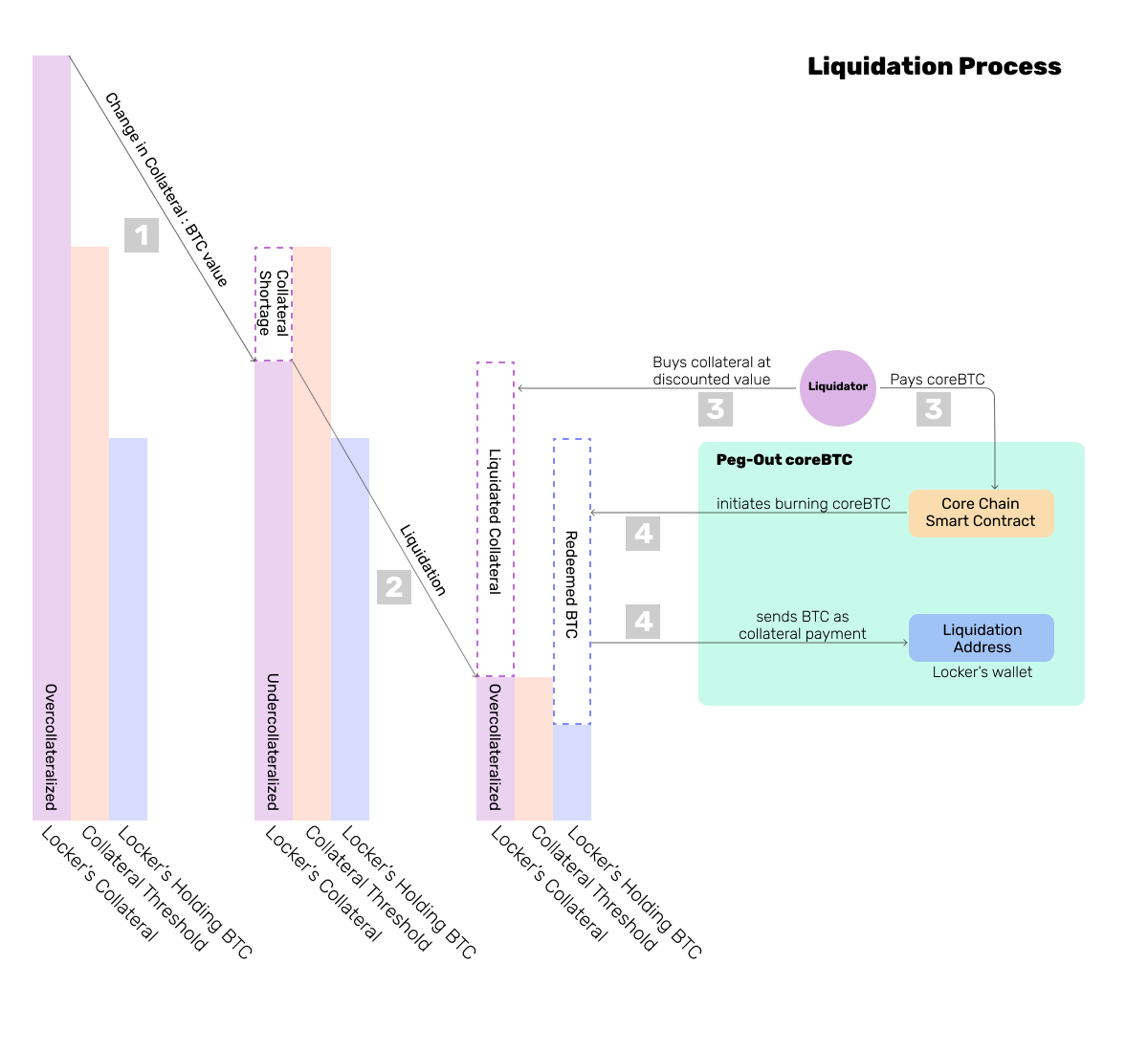

Secure coreBTC: Slashing and Liquidating

Liquidating

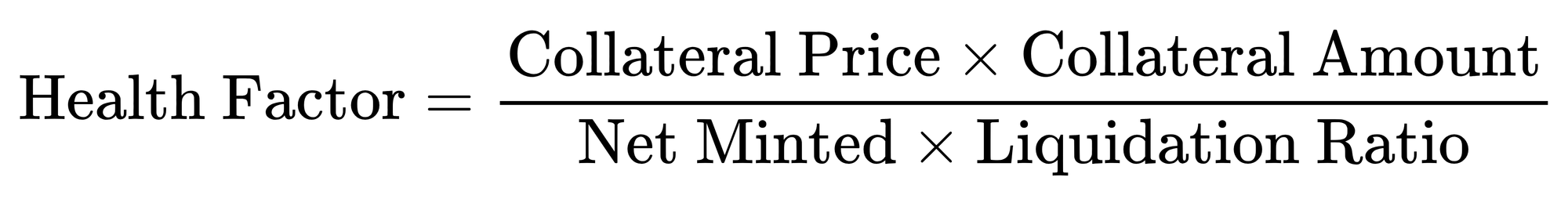

Health Factor

- Collateral Price: Collateralized $CORE price measured in $BTC

- Collateral Amount: Locker's $CORE collateral amount

- Net Minted: Total minted minus total burnt for a locker

- Liquidation Ratio: 130%

Capacity: the amount of coreBTC a locker can mint

The locker's capacity equals its collateral value in CoreBTC multiplied by the health rate minus the minted CoreBTC.

Typically, liquidators are MEV hunters who chase for profit. They monitor the locker's health rate. Once the health rate drops below 100%, they initiate liquidation. When liquidation begins, the liquidator burns coreBTC after purchasing collateral $CORE at a 10% discount until the locker stays healthy again.

Slashing

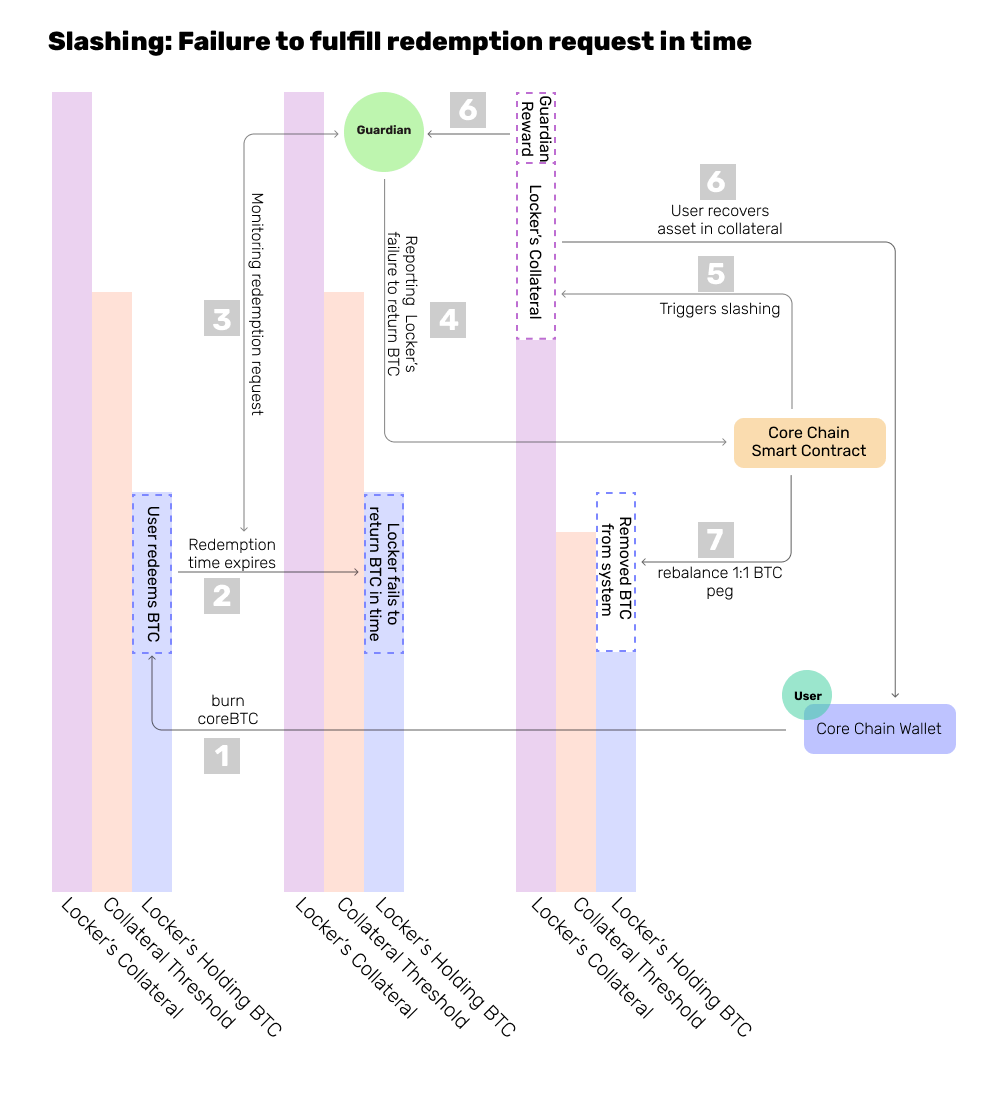

We mentioned that guardians slashed lockers when they couldn't fulfill BTC redemption requests or move BTC without burn requests. We show the steps case by case. When lockers do not execute redemption requests:

- User burn coreBTC.

- Lockers didn't fulfill requests when redemption time expired.

- Guardians monitor such cases and report them to LockersLogic smart contract.

- Contract verify lockers' failure and trigger slashing.

- Lockers are slashed with the corresponding transaction amount and rewards amount.

- Users received a small amount of compensation and principal refunds.

- Slashers received rewards.

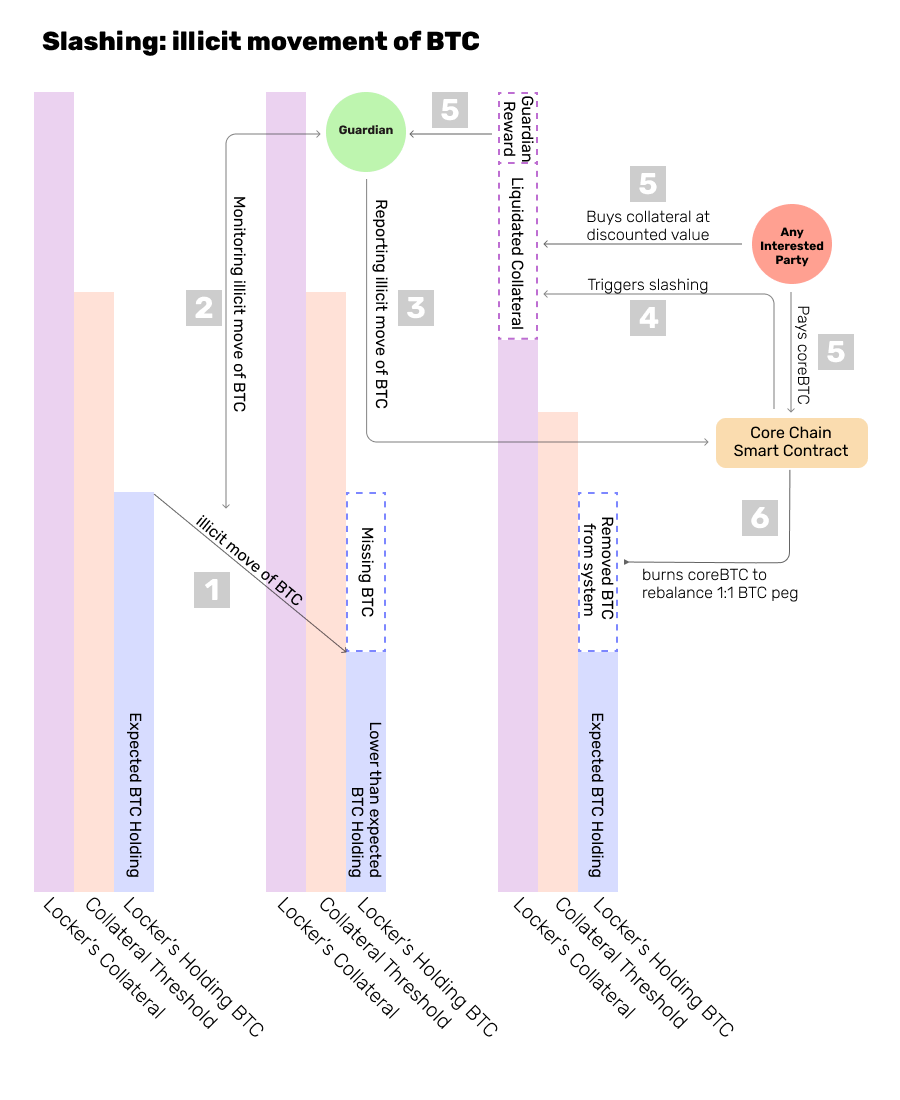

When lockers move BTC without burn requests:

- Lockers move BTC without redemption requests.

- Guardians monitor such cases and report them to LockersLogic smart contract.

- Contract verify lockers' failure and trigger slashing.

- Lockers are slashed with the corresponding transaction amount, rewards amount, and an additional 15% for burned coreBTC.

- Slashers received rewards.

- Users buy the 15% slashed collateral using CoreBTC with a discount.

- If all the needed coreBTC is collected and burnt, the rest of the slashed collateral is sent back to the locker.

Potential Risks

- Liquidation Risk: Locker may not be liquidated on time when black swan events occur, resulting in bad debts.

- Unknown Verifier Status: According to our observations, there have been 99 slashing events, all due to unavailability, with no instances of double signing. The usefulness of verifiers is still being determined.

- Centralized Lockers: Currently, there are only two lockers, which need further decentralization. Since lockers require at least $100,000 of CORE as collateral, it's difficult for enthusiasts to afford staked funds, and it may still end up being the playground of professional DeFi players.

- Oracle Risk: Core uses Pyth (preferred) and Switchboard to fetch BTC/USDT and CORE/USDT prices. If the oracle provides incorrect prices, coreBTC will be halted.

Conclusion

Core network, which aims to build BTCFi, has made significant progress in the Bitcoin ecosystem. Core's success lies in its successful trade-offs: give BTC miners and stakers rewards to attract community support and traffic; give staking rewards to CORE delegators to build a $CORE-centric ecosystem; and use EVM to attract the largest ecosystem developers at the moment.

In the future, it has plans to integrate HTLC to increase interoperability between Bitcoin and Core, making ordinals, Bitcoin NFT, and other assets more liquid.

Reference

- https://portal.vc/bitcoin

- https://messari.io/report/understanding-core-chain

- https://github.com/coredao-org/core-genesiscontract

- https://medium.com/@W3.Hitchhiker/trustless-bridge-solve-the-interoperability-crisis-and-optimize-liquidity-utilization49bcb4f7bae9

- https://www.coingecko.com/learn/bitcoin-layer-2s-top-bitcoin-layer-2s#:~:text=Bitcoin sidechain L2s are capable,communication between the main network.

-https://www.reddit.com/r/ethereum/comments/153zuqr/bridge_verification_methods_the_winner_takes_it/ - https://unlockingbitcoindefi.com/

Disclaimer

This material is provided by HashKey Digital Asset Group Limited, or its affiliates (“HashKey Group”). Unless otherwise specified, the following should be read in conjunction with any and all news releases by Hashkey Group.

This material is for general information purposes only. It does not constitute, nor should be interpreted as, any form of solicitation, offer or recommendation of any product or service. It does not constitute investment, tax or legal advice. In no event should any news release be considered as recommendation of a particular type of digital asset.

This material may include market data prepared by Hashkey Group or data from third party sources. While Hashkey Group makes reasonable efforts to ensure the reliability of such third-party information, such information may have not been verified. Graphics are for reference only. We make no representation or warranty, express or implied, to the timeliness, accuracy or completeness of the information in this material. Information may become outdated, including as a result of new plans, regulations or changes in the market. In making investment decisions, investors should not solely rely on the information contained in this material. The risk of loss in trading digital assets can be substantial and is not suitable for all investors. Any forward-looking statements in this material are subject to several conditions, uncertainties and assumptions. We undertake no obligation to update or revise any forward-looking statements.